The State Bank of India is not merely a company; it is a foundational pillar of the Indian economy. Its scale is staggering: over 22,000 branches, 65,000 ATMs, a customer base exceeding 500 million, and a presence that stretches from the remotest villages of India to the financial hubs of the world. For an investor, the SBI share price represents a bet on the health of India itself. It is a complex interplay of macroeconomic trends, regulatory mandates, internal management strategies, and global investor sentiment. Understanding what drives this price requires peeling back multiple layers, moving beyond daily ticker movements to grasp the fundamental and technical forces at work. This analysis delves deep into the factors that have shaped, and will continue to shape, the trajectory of India’s banking behemoth.Decoding SBI’s Share Price

The Bedrock: Understanding SBI’s Unique Position

Before analyzing the share price, one must appreciate what SBI is. It is the largest bank in India by assets, deposits, branches, employees, and customers. It is also the largest public sector bank, meaning the Government of India is its majority shareholder. This dual identity—as a commercial entity tasked with profitability and a national instrument tasked with financial inclusion—creates a unique dynamic. Its decisions impact millions, and government policy often directs its course. This “too big to fail” status provides immense stability but can also sometimes come at the cost of agility compared to nimble private-sector rivals.

Part 1: The Fundamental Drivers of SBI’s Share Price

The long-term movement of SBI’s stock is predominantly governed by its fundamental financial health and the environment in which it operates.

1. Asset Quality: The Non-Performing Asset (NPA) Saga

For the better part of the last decade, the single biggest factor dictating SBI’s share price performance was its asset quality, specifically its level of Non-Performing Assets (NPAs). The period following the 2008 global financial crisis saw a surge in corporate lending, which later turned sour with economic slowdowns, policy paralysis, and project stalling. This led to a massive bad loan problem across the Indian banking sector, with PSU banks like SBI bearing the brunt.

The initiation of the Asset Quality Review (AQR) by the Reserve Bank of India (RBI) in 2015 forced banks to recognize these hidden NPAs. SBI’s provisions for bad loans skyrocketed, hammering its profitability and, consequently, its share price. For years, the narrative around SBI was one of “NPA pain.” However, the last 3-4 years have marked a dramatic turnaround. Under the leadership of its management, SBI embarked on an aggressive recovery and resolution process, aided by the Insolvency and Bankruptcy Code (IBC). The successful resolution of major accounts like Bhushan Steel, Essar Steel, and others led to massive recoveries.

The key metrics investors now watch are:

- Gross NPA Ratio: The percentage of total advances that are NPAs. SBI has reduced this from alarming double-digits to much more comfortable levels (~2-3%).

- Net NPA Ratio: Gross NPAs minus provisions. This indicates the actual stress on the bank’s balance sheet and is now below 1% for SBI.

- Provision Coverage Ratio (PCR): The percentage of bad loans that are buffered by provisions. A high PCR (SBI’s is over 75%) indicates a strong capacity to absorb future shocks.

The dramatic improvement in asset quality has been the primary catalyst for the re-rating of the SBI stock from 2019 onwards, transforming it from a problem child to a market darling.

2. Profitability Metrics: The Bottom Line

Once the NPA cloud cleared, the market’s focus shifted squarely to profitability.

- Net Interest Income (NII): This is the core revenue of a bank: the difference between the interest it earns on loans and the interest it pays on deposits. A growing NII indicates healthy credit demand and efficient management of the interest rate spread. SBI has consistently posted robust NII growth, aided by strong loan growth, particularly in the retail segment.

- Net Profit: The ultimate bottom line. After years of volatility due to high provisions, SBI has now started posting record quarterly and annual profits. Consistent profitability boosts investor confidence and supports a higher share price.

- Return on Assets (ROA) and Return on Equity (ROE): These measure how efficiently the bank uses its assets and equity to generate profit. For a long time, SBI’s ROE languished in single digits, disappointing investors who sought higher returns. The recent surge in profitability has pushed ROE into the mid-teens, making it comparable to many private banks and a key reason for its premium valuation.

3. Loan Growth and Business Momentum

A bank cannot grow without expanding its loan book. SBI’s credit growth is a direct indicator of its belief in the economy and its ability to find creditworthy borrowers. Post-COVID, India has witnessed a strong capex revival and robust retail credit demand. SBI, with its vast network, is a primary beneficiary. Strong growth in home loans, personal loans, and corporate loans signals future revenue streams. The market punishes stagnation and rewards momentum.

4. Net Interest Margin (NIM)

This is a critical efficiency ratio. NIM is the difference between the yield on advances and the cost of funds, expressed as a percentage of interest-earning assets. A higher NIM means the bank is more profitable per rupee lent. SBI has managed to protect its NIMs in a rising interest rate environment, showcasing its pricing power and efficient liability management (i.e., a massive, low-cost Current Account Savings Account – CASA base).

5. The CASA Advantage

This is SBI’s crown jewel. A significant portion of its deposits comes from low-cost Current and Savings Accounts (CASA). Unlike fixed deposits, which carry higher interest rates, CASA funds are cheap. SBI’s CASA ratio typically hovers around 45%, one of the best in the industry. This low cost of funds provides a natural buffer and allows it to be competitive on lending rates while protecting its margins.

6. Macroeconomic Factors

SBI’s fate is tied to India’s.

- RBI Monetary Policy: Interest rate decisions by the RBI directly impact SBI’s lending and borrowing rates. A hiking cycle can pressure margins, while a cutting cycle can stimulate loan demand.

- GDP Growth: A growing economy generates more business for loans, investments, and transaction banking. A slowdown does the opposite.

- Government Policy: Initiatives like infrastructure pushes, production-linked incentive (PLI) schemes, and financial inclusion programs directly benefit SBI due to its dominant size and reach.

- Inflation: High inflation forces the RBI to hike rates, which can slow down economic activity and credit growth.

Part 2: Technical and Sentiment Analysis

While fundamentals dictate the long-term trend, short-to-medium-term price movements are influenced by technical and market sentiment factors.

- Technical Analysis: Chartists analyze support and resistance levels, moving averages (like the 50-day and 200-day EMA), and indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to identify entry and exit points. For a stock as liquid as SBI, technical patterns often play out with significant volume.

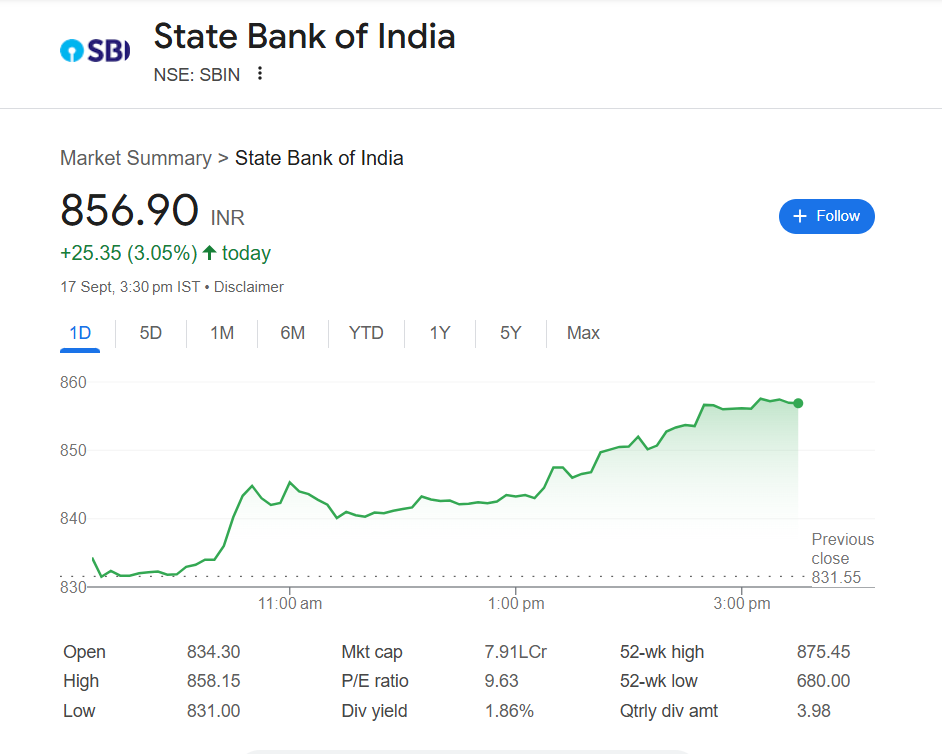

- Relative Valuation: Investors constantly compare SBI’s valuation metrics—Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio—with those of its peers like HDFC Bank, ICICI Bank, and Kotak Mahindra Bank. For years, SBI traded at a discount to these private banks due to its perceived inefficiencies and NPA issues. The convergence of this valuation gap has been a major theme recently.

- Global and Domestic Flows: The buying and selling activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) cause significant volatility. Global risk appetite, US Fed policies, and emerging market flows heavily influence FII activity in a bellwether stock like SBI.

- Government Stake: As the government is the majority owner, any talk of disinvestment or stake sale can trigger speculation and movement in the stock price.

- Sector Rotation: Sometimes, investors move money en masse from one sector (e.g., IT) to another (e.g., Banking). This “sector rotation” can benefit SBI disproportionately due to its high weightage in key indices.

Part 3: The Valuation Conundrum: P/B and P/E

Valuing a bank is different from valuing a manufacturing company. The preferred metric is often the Price-to-Book Value (P/B) ratio, which compares the market price to its net asset value per share.

- Historical P/B Band: SBI has historically traded within a certain P/B range (e.g., 0.8x to 2.5x book value). When asset quality was poor, it traded near or even below its book value, implying the market had no faith in the stated value of its assets. As confidence returned, it began to trade at a premium to book value.

- Justifying the Premium: The current premium valuation is based on the market’s belief that SBI’s improved profitability (ROE of ~18%) is sustainable. The argument is that it is no longer just a slow-growing PSU bank but a “value franchise” with the distribution network of a PSU and the profitability approaching that of a private bank.

- P/E Ratio: With earnings becoming stable and predictable, the Price-to-Earnings (P/E) ratio has also gained prominence. The market is essentially paying a higher multiple for SBI’s earnings because it expects those earnings to grow consistently.

Part 4: Risks and Challenges on the Horizon

No investment is without risk, and SBI is no exception.

- Macroeconomic Shocks: A severe global or domestic economic downturn could lead to a new cycle of loan defaults, testing the bank’s improved asset quality and high provisions.

- Competition: The competitive landscape is ferocious. Aggressive private banks, specialized Non-Banking Financial Companies (NBFCs), and now fintech companies are constantly encroaching on traditional banking turf, especially in the high-margin retail segment.

- Technological Disruption: While SBI has invested heavily in digital platforms like YONO, its sheer size can make it less agile than smaller, tech-native competitors. Keeping pace with the digital revolution is an ongoing challenge and a significant cost.

- Operational Inefficiencies: As a behemoth with a vast employee base, managing costs remains a challenge. Wage revisions, a significant component of its expenses, are negotiated through industry-wide unions and can impact margins.

- Regulatory Changes: Any drastic change in RBI regulations concerning capital, liquidity, or lending norms can impact business operations and profitability.

Part 5: The Future Outlook and Investment Perspective

The future of the SBI share price hinges on its ability to execute its strategy in a favorable macroeconomic climate.

- Sustained Profitability: The market will expect SBI to maintain its ROE in the mid-to-high teens, proving that the recent performance is not a one-off but a new normal.

- Digital Dominance: The success of its YONO platform is critical. It is not just a banking app but a comprehensive financial ecosystem. Monetizing this vast digital user base will be a key growth driver.

- Market Share Gains: As smaller and weaker banks struggle, SBI’s strength allows it to gain market share organically, particularly in the corporate lending space where trust and balance sheet size matter.

- ** Subsidiary Value Unlocking:** SBI has valuable subsidiaries in areas like life insurance (SBI Life), mutual funds (SBI MF), and credit cards (SBI Card). The market often values the sum of these parts as higher than the parent company’s standalone value, a phenomenon known as “value unlocking.”

Conclusion: A Titan Transformed

The journey of the SBI share price is a story of resilience, reform, and renewal. From being weighed down by the legacy of bad loans, it has engineered one of the most remarkable turnarounds in Indian corporate history. It has shed its image as a sluggish PSU and is increasingly being viewed as a well-oiled financial giant capable of delivering consistent returns.

Investing in SBI is now less a speculative bet on a recovery and more a strategic bet on India’s growth story, executed by its most powerful financial institution. It offers a unique combination of size, stability, improving profitability, and a unparalleled distribution network. While risks from competition, technology, and the economic cycle persist, the fundamental story appears stronger than it has in over a decade. The SBI share price is no longer just a number on a screen; it is a barometer for the health of a resurgent bank and, by extension, a confident, growing India. For the discerning investor, it represents a compelling opportunity to own a piece of the nation’s economic backbone, provided they have the patience and perspective to look beyond quarterly noise and focus on the enduring trajectory.