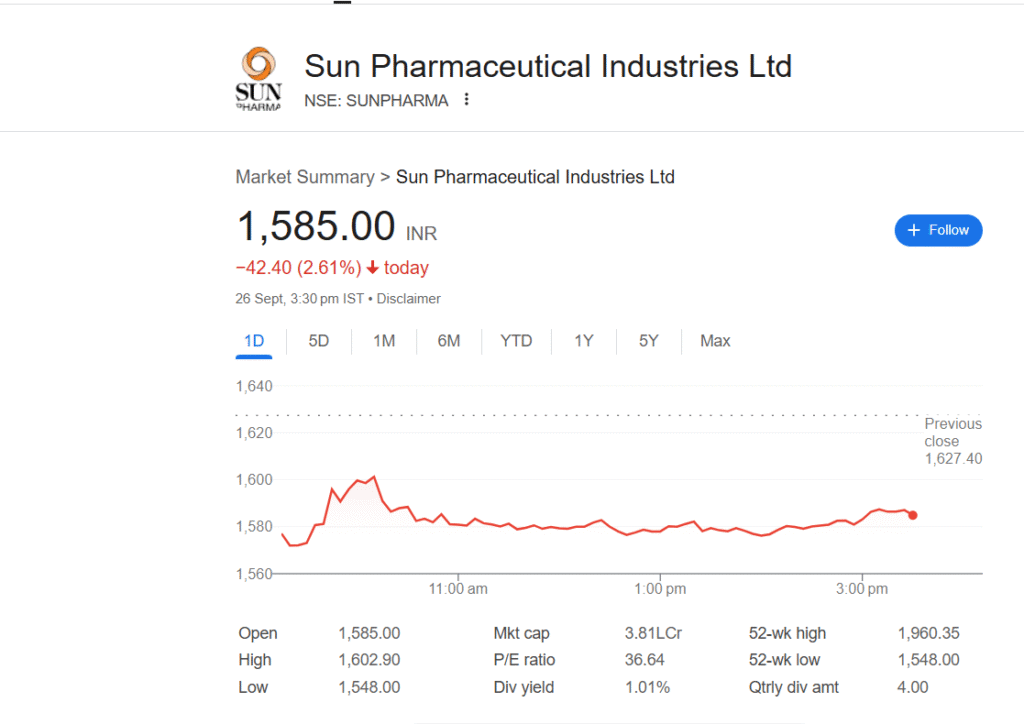

The Sun Pharmaceutical Industries Ltd. scrip, trading under the ticker symbol SUNPHARMA on the NSE and BSE, is more than just a stock; it is a barometer for the Indian pharmaceutical sector. For millions of retail investors, institutional funds, and market analysts, the fluctuations in the Sun Pharma share price tell a story of resilience, strategic pivots, regulatory challenges, and global ambitions. Understanding this share price requires moving beyond daily charts and volume data. It demands a holistic examination of the company’s journey, its fundamental strengths, the complex industry it operates in, and the future it is trying to shape.Sun Pharma Share Price

This article delves deep into the multifaceted world of Sun Pharma, unraveling the key drivers, historical context, and future prospects that collectively determine the trajectory of its share price.

I. The Historical Canvas: From Humble Beginnings to Market Dominance

To appreciate the present, one must first understand the past. Sun Pharma’s story is a classic Indian entrepreneurial saga. Founded in 1983 by Dilip Shanghvi with five psychiatry products, the company’s initial strategy was simple yet effective: focus on niche, chronic-therapy areas that were underserved by larger players. This focus provided stable, recurring revenue.

The 1990s and early 2000s were characterized by aggressive growth through acquisitions. Sun Pharma mastered the art of identifying struggling or undervalued companies, acquiring them, and turning them around by improving operational efficiency and leveraging its own distribution network. Key acquisitions like Caraco Pharma Labs in the US provided a crucial foothold in the world’s largest pharmaceutical market.

However, the most defining, and perhaps most turbulent, chapter in its history was the acquisition of Ranbaxy Laboratories from Japan’s Daiichi Sankyo in 2014. On paper, it was a masterstroke—a move that instantly made Sun Pharma the largest pharmaceutical company in India and the fifth-largest specialty generic pharmaceutical company globally. The Sun Pharma share price initially reacted with optimism.

But Ranbaxy came with a heavy burden: a legacy of US Food and Drug Administration (USFDA) compliance issues. Sun Pharma inherited manufacturing bans on multiple Ranbaxy plants, which severely hampered the combined entity’s ability to supply the critical US market. The following years were a period of intense consolidation, remediation, and significant financial strain. The share price witnessed a prolonged period of stagnation and volatility as the company worked tirelessly to resolve these issues. This phase was a critical test of management’s capabilities and patience for shareholders.

The successful integration and eventual resolution of most of these compliance issues marked a major turning point. It demonstrated Sun Pharma’s operational prowess and risk-management capabilities, restoring investor confidence and setting the stage for the next growth phase.

II. Fundamental Analysis: Deconstructing the Business Engine

The Sun Pharma share price is ultimately a reflection of the company’s fundamental health. A granular look at its business segments, financials, and strategy is essential.

1. The Geographic Revenue Mix: A Story of Diversification

Sun Pharma’s revenue streams are well-diversified across the globe, which is a key strength, insulating it from region-specific economic or regulatory shocks.

- United States: This is the single largest market, contributing nearly 30-35% of total revenue. The business here is primarily generics, driven by a pipeline of Abbreviated New Drug Applications (ANDAs). The performance in the US is highly sensitive to pricing pressure, which is a systemic issue for the generics industry, and the pace of new product launches. The Sun Pharma share price often reacts sharply to news related to USFDA approvals or observations.

- India: The domestic formulation business is the second-largest revenue contributor (about 25-30%) and a source of immense strength. Sun Pharma holds a leadership position in several chronic therapy areas like cardiology, neurology, and diabetology. The Indian business is characterized by strong brand loyalty, a vast distribution network reaching even remote areas, and relatively stable pricing. This segment provides a steady cash flow that supports other ventures.

- Emerging Markets (EM): This includes regions like Asia, Latin America, Africa, and the Middle East, contributing another 15-20%. Growth here is tied to increasing healthcare penetration, economic development, and Sun Pharma’s ability to tailor its product portfolio to local needs.

- Rest of the World (RoW): This includes developed markets like Europe and Japan, contributing the remainder. The focus here is on building a presence in more complex, value-added products.

2. The Specialty Revolution: A Strategic Pivot

The most significant strategic shift for Sun Pharma in the last decade has been its foray into the specialty business. Generics, while a large market, are inherently competitive and prone to severe price erosion. Specialty drugs, on the other hand, are complex, often biologics or novel formulations, protected by patents or regulatory exclusivity, and command significantly higher margins.

The flagship product of this strategy is ILUMYA® (tildrakizumab-asmn), a biologic used to treat moderate-to-severe plaque psoriasis. Launched in the US in 2019, ILUMYA’s journey is closely watched by investors. Its commercial success is critical because it validates Sun Pharma’s ability to compete in the high-stakes, innovation-driven US specialty market. The company has had to build a specialized sales force from the ground up to detail this product to dermatologists, a costly but necessary investment. The quarterly sales figures for ILUMYA are a key metric that analysts scrutinize, and positive trends have a direct positive impact on the Sun Pharma share price.

Other key specialty assets include:

- LEVULAN® (aminolevulinic acid hydrochloride): For the treatment of actinic keratoses.

- WINLEVI® (clascoterone cream): The first-in-class topical treatment for acne.

- CEQUA® (cyclosporine ophthalmic solution): For dry eye disease.

The success of this portfolio reduces the company’s dependence on plain generics and is a major factor in margin expansion, which is a bullish signal for the stock.

3. Financial Metrics: The Bottom Line

The Sun Pharma share price finds its anchor in the company’s financial performance.

- Revenue and Profitability: Consistent growth in top-line (revenue) and bottom-line (net profit) is paramount. Investors look for not just growth, but the quality of growth. Is it driven by high-margin specialty sales or low-margin generics? Improving EBITDA margins are a sign of efficient operations and a favorable product mix.

- Research & Development (R&D) Expenditure: Sun Pharma invests a significant amount (around 7-8% of sales) in R&D. This spending is directed towards developing complex generics, filing ANDAs, and building the specialty pipeline. While high R&D can suppress short-term profits, it is essential for long-term sustainability. The market rewards a productive R&D pipeline that leads to successful launches.

- Balance Sheet Strength: After the debt-heavy Ranbaxy acquisition, Sun Pharma has focused on deleveraging. A strong, cash-rich balance sheet provides the flexibility to fund internal R&D, make strategic acquisitions, and weather industry downturns without distress.

III. External Forces: The Ecosystem That Shapes the Price

The Sun Pharma share price does not exist in a vacuum. It is constantly buffeted by a multitude of external factors.

1. Regulatory Oversight: The Sword of Damocles

The USFDA is arguably the most influential external entity for Sun Pharma. The company has multiple manufacturing facilities that are subject to rigorous FDA inspections. An FDA Form 483 (listing observations) or, worse, a Warning Letter or Import Alert, can lead to a sharp, immediate decline in the share price. Such actions can halt production from a facility, disrupting supplies to the US market and crippling revenue. The market’s confidence is heavily dependent on the company’s track record of maintaining good regulatory standing.

2. The Generic Pricing Conundrum

The US generics market has been plagued by intense price competition for years. Consolidation among wholesale buyers (like wholesalers, pharmacy benefit managers – PBMs) has given them significant bargaining power, leading to consistent year-on-year price erosion. This is a structural headwind for Sun Pharma’s generics business. The share price reflects the market’s assessment of the company’s ability to manage this pressure through cost optimization and a shift to more complex, difficult-to-manufacture generics that face less competition.

3. Legal and Litigation Risks

The pharmaceutical industry is rife with legal challenges. Sun Pharma has faced its share, including antitrust litigations in the US and ongoing scrutiny from the Securities and Exchange Board of India (SEBI) regarding certain governance matters. While the financial impact of such issues can be hard to quantify, they create uncertainty, which the market abhors. Negative news on this front can lead to volatility and a valuation discount until the issues are resolved.

4. Macroeconomic Factors

Broader economic conditions also play a role. Interest rate hikes by central banks can make growth stocks (which Sun Pharma is often categorized as, due to its specialty aspirations) less attractive compared to bonds. Currency fluctuations are also critical. A weakening Indian Rupee against the US Dollar is generally positive for Sun Pharma, as its dollar-denominated revenues from the US market translate into higher rupee-terms profits. Conversely, a strengthening rupee can be a minor headwind.

IV. The Investment Thesis: Bull vs. Bear

The debate around the Sun Pharma share price is a constant tug-of-war between bullish and bearish perspectives.

The Bull Case:

- Specialty-Driven Growth: Bulls believe the specialty business is at an inflection point. With ILUMYA gaining market share and other products like WINLEVI scaling up, this high-margin segment will become the primary growth engine, re-rating the stock to a higher valuation multiple.

- Dominant Domestic Presence: The strong, cash-generative India business provides a stable foundation and funds future investments, reducing overall business risk.

- Proven Management: Under Dilip Shanghvi’s leadership, the company has navigated extreme challenges (like the Ranbaxy integration). Bulls have faith in management’s long-term vision and execution capabilities.

- Attractive Valuation: Compared to global specialty pharma peers, Sun Pharma often trades at a discount. Bulls see this as a buying opportunity, believing the market has not yet fully priced in the potential of the specialty pipeline.

The Bear Case:

- US Generics Pressure: Bears argue that the relentless price erosion in the US generics market will continue to offset growth in other areas, capping overall profitability.

- Execution Risk in Specialty: Building a specialty business is expensive and difficult. Bears question whether Sun Pharma can effectively compete against deep-pocketed global giants like Johnson & Johnson, AbbVie, and Pfizer in the marketing of specialty drugs.

- Regulatory Overhang: The fear of a fresh USFDA compliance issue is ever-present. A significant regulatory setback could severely damage the growth narrative and the share price.

- Governance Concerns: Past governance issues, though being addressed, lead some institutional investors to apply a cautionary discount to the stock’s valuation.

V. Peer Comparison and Valuation

Sun Pharma is the undisputed leader in the Indian pharmaceutical space. However, it is essential to compare it with its closest peers like Dr. Reddy’s Laboratories, Cipla, and Divis Laboratories on key parameters like Price-to-Earnings (P/E) ratio, Earnings Per Share (EPS) growth, and Return on Equity (RoE).

Typically, Sun Pharma commands a premium valuation compared to peers that are more reliant on generics, due to its specialty aspirations. However, it might trade at a discount to a company like Divi’s Labs, which has a unique and highly profitable business model in active pharmaceutical ingredients (APIs). Analyzing these relative valuations helps investors determine if the Sun Pharma share price is fairly valued, overvalued, or undervalued within its sector.

VI. The Future Trajectory: What Lies Ahead?

The future direction of the Sun Pharma share price will be determined by several key factors:

- Pipeline Productivity: The success of the late-stage R&D pipeline, especially in specialty dermatology and ophthalmology, is crucial. New molecular entities (NMEs) under development will be the next big trigger.

- Geographic Expansion: How successfully can the company launch its specialty products in new markets like Europe and Japan?

- Biosimilars and Complex Generics: The development of biosimilars (generic versions of biologic drugs) represents a significant future opportunity, though it is capital-intensive and risky.

- Digital and Technological Integration: Leveraging digital tools for marketing, patient engagement, and supply chain efficiency will be a key differentiator.

Conclusion: A Stock of Substance and Potential

The Sun Pharma share price is a dynamic entity, a synthesis of a storied past, a complex present, and a promising but challenging future. It is not a stock for the faint-hearted or short-term speculator. It is an investment in a well-established franchise with a clear strategic direction.

For an investor, Sun Pharma represents a bet on the successful execution of its specialty transformation. The journey from a generics powerhouse to a global specialty pharmaceutical player is fraught with risks, but the potential rewards are substantial. It requires patience, a long-term horizon, and a deep belief in the management’s ability to deliver.

Daily fluctuations will always occur, driven by market sentiment, news flow, and broader economic conditions. But the long-term trend will be dictated by the fundamental pillars of revenue growth, margin expansion, and regulatory compliance. For those who believe in the story, every dip might be a buying opportunity. For the skeptics, the stock will remain a “wait and watch” proposition. In the grand tapestry of the Indian stock market, Sun Pharma remains a pivotal thread, its share price a continuous narrative of ambition, resilience, and the relentless pursuit of growth.

qonaoe