Credit has always been based on numbers. For almost a century, banks decided who deserves a loan based on income, repayment history, assets, and risk scores. This traditional model gave rise to the modern credit score — a single number that summarises how safely a person borrows and repays money.Credit Score vs Social Score

But the world is changing fast. As we step deeper into the digital economy, a new idea is emerging: social scoring — a system where your behaviour, network, digital footprints, and social reputation influence your financial opportunities.

In simple terms:

- Credit Score asks: “How did you repay money in the past?”

- Social Score asks: “How do you behave, interact, and contribute as a person?”

This shift is not science fiction. It is already happening. Fintech lenders, BNPL platforms, gig-economy apps, ride-sharing platforms, influencer marketplaces, and even insurance companies are experimenting with behavioural underwriting.

This article explores how this transformation works, who benefits, who is at risk, and how future lending might reward — or punish — your behaviour.

Part 1: Understanding Credit Score — The Old Financial Identity

What Exactly Is a Credit Score?

A credit score represents your:

✔ Borrowing history

✔ Repayment behaviour

✔ Credit utilization

✔ Defaults or delinquencies

✔ Length of credit history

In most systems, it ranges from 300 to 900 (or 850 in the FICO model).

Higher scores mean:

- lower interest rates

- easier approvals

- higher limits

- better terms

Credit scoring is built on the logic:

“Past financial behaviour predicts future financial reliability.”

This model works — but only up to a point.

The Weakness of Credit Scores

Credit scores ignore:

✘ informal transactions

✘ gig income profiles

✘ freelance earning volatility

✘ personal values and behaviours

✘ digital reputation

✘ collaborative or ethical conduct

✘ online trustworthiness

Example:

A YouTuber earning ₹3 lakh/month may struggle to get a loan due to unpredictable income, while a salaried employee earning ₹60,000/month gets approved easily.

This gap opens the door to new models.

Part 2: The Rise of Social Scoring — More Than Money

What Is a Social Score?

A social score evaluates how responsible, verified, and trustworthy you are through non-financial behaviour:

✔ Communication patterns

✔ Network credibility

✔ Online reputation

✔ Ratings and reviews

✔ Platform conduct

✔ Legal compliance

✔ Workplace behaviour

✔ Travel patterns

✔ Community contributions

It shifts the question from:

“Can you repay?”

to

“Should we trust you?”

Part 3: Why Finance Is Moving Toward Behavioural Underwriting

1. Income is No Longer Linear

Traditional lending assumes:

stable salary + stable job = stable repayment

But millions now work in:

- freelancing

- gig economy

- creator economy

- self-employment

- flexible contracts

Income is volatile, not fixed.

2. Digital Reputation Has Become Quantifiable

Platforms like:

- Uber

- Airbnb

- Swiggy/Zomato

- Fiverr

- Upwork

- Shopee

- YouTube

already assign ratings, reviews, and verification badges.

These rating systems reward:

✔ reliability

✔ punctuality

✔ professionalism

✔ communication

✔ trust

These traits are economically valuable.

3. Data Is More Available Than Ever

Banks once relied on limited data. Today they have access to:

- social analytics

- behavioural data

- spending patterns

- digital footprints

- peer-validation signals

Data makes behavioural lending mathematically possible.

Part 4: How Lenders Are Experimenting with Behaviour Scoring

1. BNPL (Buy Now Pay Later)

Apps like Klarna, Afterpay, LazyPay and Simpl track:

✔ purchase behaviour

✔ impulse control

✔ repayment punctuality

✔ spending categories

2. Ride Sharing & Delivery Platforms

Uber riders who consistently get low ratings may be flagged as:

“High risk — low consideration borrower type.”

Behaviour matters.

3. Creator Economy Financing

Influencers are now getting loans secured against:

✔ engagement consistency

✔ brand reputation

✔ social credibility

✔ growth metrics

This would be impossible with just credit score.

Part 5: What Exactly Impacts a Social Score?

Not officially standardized yet, but emerging signals include:

(A) Reputation Signals

- verified profiles

- real identity

- endorsements

- referrals

- reviews

(B) Behavioural Signals

- punctuality

- rule compliance

- communication style

- dispute frequency

- return/refund patterns

(C) Relationship Signals

- network credibility

- follower authenticity

- community participation

(D) Consumption Signals

- ethical consumption

- payment punctuality

- financial discipline

- impulse control

Part 6: How This Will Affect Lending Decisions

Lenders of the future may classify borrowers into four personas:

1. Credit-Strong + Social-Strong

Best possible borrower:

✔ high trust

✔ high repayment reliability

✔ low risk

Gets:

- lowest interest rates

- large loans

- premium products

2. Credit-Strong + Social-Weak

Traditional salaried employee with poor digital reputation.

Banks may trust repayment but distrust behaviour.

3. Credit-Weak + Social-Strong

Gig workers, influencers, artists.

Future lenders may reward them with:

✔ special income-underwriting models

✔ social-backed collateral

4. Credit-Weak + Social-Weak

Highest risk category.

Part 7: Will Social Score Replace Credit Score?

Not fully.

Social score will not replace — it will layer on top of credit score.

Credit score = repayment trust

Social score = behavioural trust

Together they form identity trust.

Part 8: Ethical & Risk Concerns

This shift also raises serious concerns:

1. Privacy

If lenders track behaviour, how much is too much?

2. Class Bias

Professionals with visible careers may get unfair advantages.

3. Social Control

If behaviour influences opportunity, people may self-censor online.

4. Algorithmic Bias

AI models may reinforce stereotypes or discrimination.

Governments may intervene soon.

Part 9: Country Case Studies

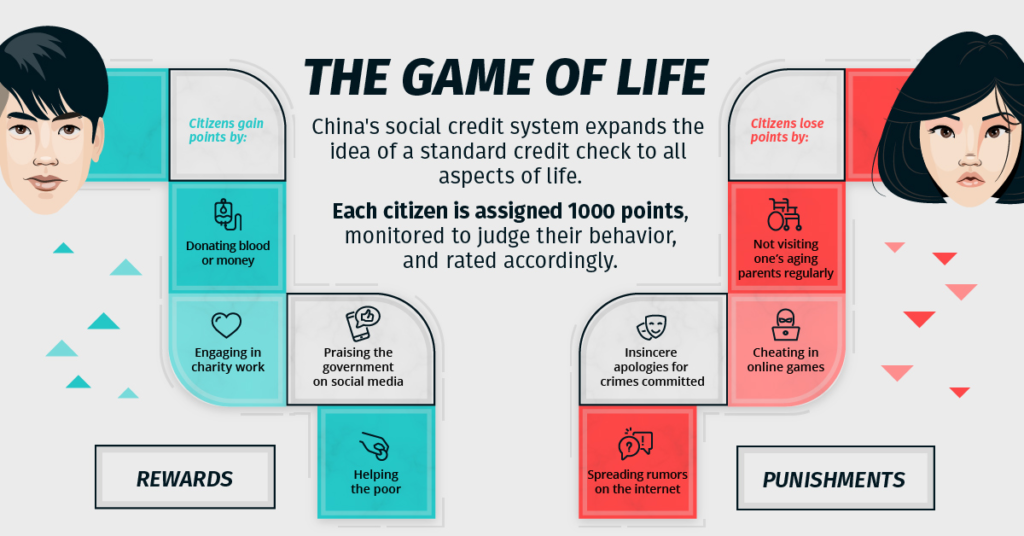

China — A Controversial Example

China experimented with social scoring that impacted:

- travel eligibility

- loan access

- school admissions

- employment

Critics argued it became behavioural surveillance.

United States — Market-Driven Model

US fintechs evaluate:

- rent payments

- utility bills

- subscriptions

- social reputation

without direct government enforcement.

India — Hybrid Model Emerging

India’s digital lending ecosystem is already experimenting with:

✔ UPI transaction behaviour

✔ digital footprint scoring

✔ alternative income evaluation

✔ telecom payment records

Part 10: Future Predictions — The Next 10 Years of Lending

Based on current trends:

1. Trust Will Be Multi-Dimensional

Not just can you repay, but can society trust you.

2. Reputation Will Become Collateral

A verified creator with real influence may use attention as collateral.

3. Behaviour Will Determine Pricing

Interest rates will vary by behaviour, not just income.

4. Micro-Finance Will Boom for the Creator & Gig Classes

Traditional banks will lose dominance to fintech lenders.

Part 11: How to Build a High Social-Lending Profile

Practical steps:

✔ maintain digital authenticity

✔ communicate professionally

✔ avoid fraud, returns, disputes

✔ maintain platform ratings

✔ keep financial discipline

✔ show reliability in small transactions first

Conclusion: Behaviour Is the New Credit

The 20th century rewarded financial discipline.

The 21st century will reward behavioural discipline.

In future lending systems:

Money + Behaviour = Opportunity

Your financial identity will no longer be defined by one number.

Credit scores measure responsibility.

Social scores measure character.

Together, they will define trust in the digital economy.

FAQ (SEO Section)

Q1: Will social scoring affect loan eligibility?

Yes — behavioural underwriting is already being tested by fintech lenders.

Q2: Will social scores reduce discrimination?

It depends on regulation; without safeguards it may increase bias.

Q3: Which industries will adopt it first?

BNPL, creator financing, gig lending, micro-credit, and digital insurance.